Understand The Difference Between Occurrence and Claims Made Policies

The below table highlights the differences between Occurrence and Claims Made Policies.

| CLAIMS MADE CONTRACTS | OCCURRENCE CONTRACTS |

|

Claims made coverage is operative only if a claim is made in the policy period and provides indemnity for acts, errors or omission that occurred during or prior to the period of insurance up to the retroactive date of the policy (and the insured had no prior knowledge of the incident/circumstance prior to the period of insurance). In a Claims Made contract the policy must be in force:

|

Occurrence based coverage is triggered by an occurrence or event during the period of insurance, irrespective of the date the claim was made. In an Occurrence contract, the policy must be in force:

|

|

Changing from a Claims Made Policy to an Occurrence Policy The occurrence policy wording will not cover claims made that relate to incidents outside the policy period. If changing from a claims made policy to an occurrence policy, the policyholder will need to purchase Run off Cover to provide protection for their business activities prior to the inception of the ‘occurrence policy’, or negotiate prior cover with their new insurer, rather than purchasing Run off Cover. |

Changing from an Occurrence Policy to a Claims Made Policy If the policyholder moves from an occurrence based policy to claims made policy, there are no issues. As incidents that occurred during the policy period are covered (subject to the terms of the cover), there is no consideration for the expiring occurrence wording. |

|

Changing Policy Cover from one Insurer to Another For claims made policies, it is important to negotiate both full retroactive cover and a continuous cover endorsement with the new insurer. |

Changing Policy Cover from one Insurer to Another For occurrence policies, there are no issues to the occurrence wording. |

|

The following types of insurance are commonly termed “Claims Made” contracts of insurance:

|

Types of Occurrence Policies The following types of insurance are commonly termed “Occurrence” contracts of insurance:

|

The following diagrams illustrate the difference between Claims Made Policies and Occurrence Policies based on an incident arising whilst a policy was current in Year 1.

Claims Made Policy

With Claims Made Policies, once you have stopped paying your premium, you are no longer covered for unreported claims. Therefore it is imperative to notify potential claims to your insurer immediately and whilst the policy is current and in force.

The following types of insurance are commonly termed “Claims Made” contracts of insurance:

- Professional Indemnity Insurance

- Directors and Officers Liability Insurance

- Management Liability Insurance

- Employment Practices Liability Insurance

- Fidelity Insurance

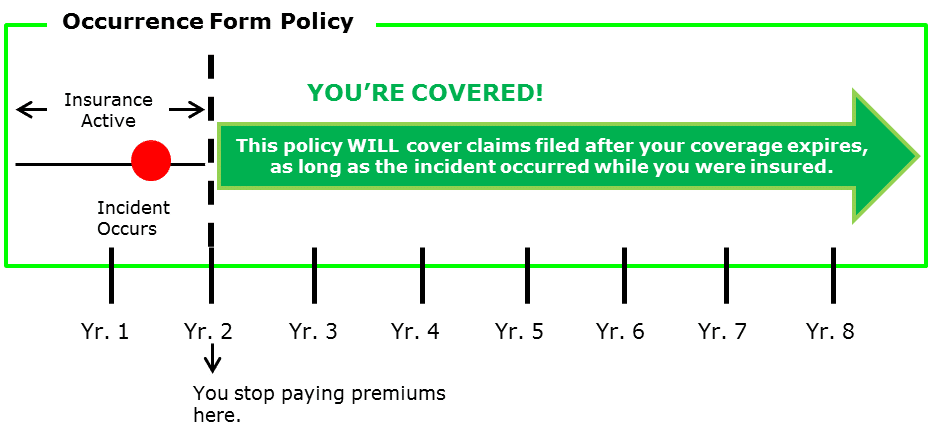

Occurrence Policy

With Occurrence policies, as long as the incident occurs whilst the policy is current and in force, you remain covered.

The following types of insurance are commonly termed “Occurrence” contracts of insurance:

- Public and Products Liability Insurance

- Business Property Insurance

- Motor Vehicle Insurance

After Advice or A Quote?

Optimum Insurance Services are qualified insurance advisers. We welcome all enquiries in relation to our insurance products and services. To obtain advice or a competitive quotation enquire online. If you would like to discuss your specific needs further, please call 1300 739 861 and speak with our friendly and helpful advisers.